Choosing between high-risk, high-return options and low-risk, low-return choices is crucial in various aspects of life, including economic activities like investing. Despite its significance, the neural circuits responsible for this decision-making remain mostly unknown.

In a recent study published in Science, researchers led by Dr. Tadashi Isa at the Institute for the Advanced Study of Human Biology (WPI-ASHBi) and Graduate School of Medicine/Kyoto University identified and selectively manipulated neural circuits using optogenetics. This method uses light to modulate the activity of specific neurons.

The study focused on the distinct neural circuits responsible for decision-making in primates, explicitly balancing risk vs. reward-return choices. The findings suggest that stimulating these circuits leads to behavioral changes that accumulate over time and have long-term consequences, offering insights into potential mechanisms underlying pathological risk-taking behaviors such as gambling disorders.

Various experimental paradigms, including the well-known Iowa Gambling Task, have been developed to assess decision-making behavior. However, these neuropsychological tasks often need to be revised in their design, preventing a complete separation of higher-order cognitive processes.

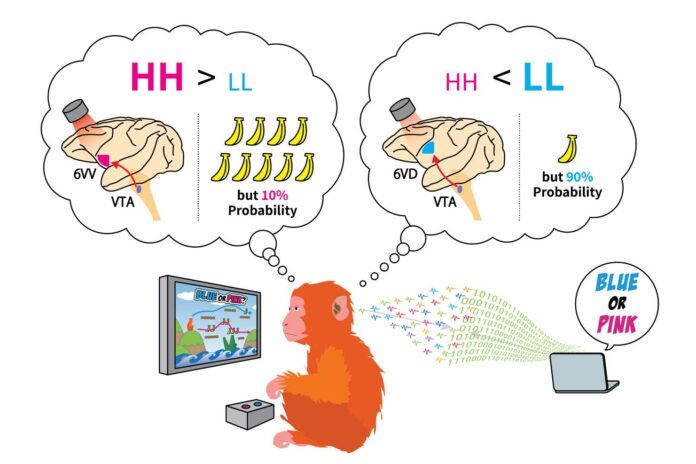

In their study, Isa and his team designed a unique decision paradigm to isolate the choice bias between high-risk, high-reward (HH) and low-risk, low-reward (LL) decisions. Macaque monkeys were trained to perform a cue/target choice task with water as a reward using eye movements as indicators.

The task involved 5 different HH-LL choices across 5 sets, totaling 25 potential options with equivalent “expected value.” The results showed that, like other primate studies, the monkeys displayed an inherent bias for HH over LL choices.

The researchers focused on Brodmann area 6V, traditionally considered a motor area, to investigate its role in decision-making. They selectively manipulated and observed the neural circuits in this region using optogenetics, a technique that uses light to modulate the activity of specific neurons. Their findings suggested a link between area 6V and risk-reward decision-making in primates, shedding light on the neural mechanisms involved in such processes.

Using the selective GABAA receptor agonist muscimol to inactivate various candidate frontal brain regions pharmacologically, the researchers pinpointed the ventral part of area 6V (area 6VV) responsible for high-risk, high-reward (HH) choice behavior. Surprisingly, inactivating regions traditionally considered central to reward-based decision-making, such as the orbitofrontal cortex (OFC) and the dorsal anterior cingulate cortex (aACC), had minimal impact on the preference for HH choices.

Dr. Ryo Sasaki, the first author of the study said, “Indeed, we were really surprised that neither the OFC nor the aACC were important for risk-dependent decision-making.”

The researchers utilized an optogenetic approach to investigate the role of the mesofrontal pathway in risk-dependent decision-making. They implanted an array of 29 LEDs coupled to electrocorticogram (ECoG) electrodes into area 6V of primate brains, allowing precise manipulation of neural activity in the ventral part of area 6V (area 6VV) through optogenetic stimulation of specific ventral tegmental area (VTA) terminals.

The study revealed two subcircuits within the mesofrontal pathway: the VTA-6VV pathway was associated with high-risk, high-reward (HH) preferences, while the VTA-6VD pathway was linked to low-risk, low-reward (LL) preferences.

Sasaki said, “The spatiotemporal resolution of our LED/ECoG array was essential in distinguishing the VTA-6VV and VTA-6VD pathways and deciphering their distinct functional roles in risk-dependent decision-making.”

Isa said, “Interestingly, upon repetitive stimulation of either the VTA-6VV or the VTA-6VD pathways, Isa and coauthors observed cumulative effects that persisted over time, leading to long-term changes in preference for HH and LL choice in primates, respectively — independent of any photostimulation.”

“Such long-term changes in choice behavior were rather unexpected, and … but this may now also offer a mechanistic explanation for how gambling disorders arise.”

Journal Reference:

- Ryo Sasaki, Yasumi Ohta et al. Balancing risk-return decisions by manipulating the mesofrontal circuits in primates. Science. DOI: 10.1126/science.adj6645