Understanding decisions under risk is crucial for public health. Excessive risk-taking relates to addiction and dangerous behaviors, whereas inadequate risk-taking leads to missed opportunities. Any uncertainty avoidance, either in the laboratory or real life, can be considered ‘risk aversion,’’ but such departure can come from distinct cognitive constructs.

The most common framework to explain risk aversion in economics is expected utility theory. The core idea of the theory is that external rewards (food, water, or money) are converted into an internal subjective value or ‘utility.’

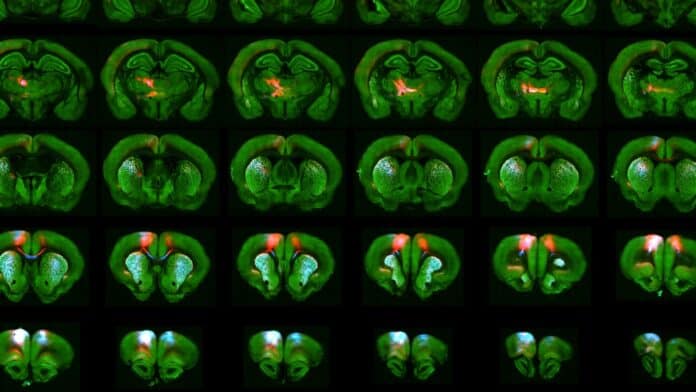

Neuroscientists from Sainsbury Wellcome Centre at UCL and NYU Shanghai have uncovered a key brain area in rats that encodes the value of economic choices when faced with the uncertainty of a lottery. They found that rats’ frontal and parietal cortex play critical roles in financial decisions under risk.

The causal involvement of the frontal and parietal cortex in economic decision-making has never been examined before. The results lay the groundwork for comprehending the neuroscience of risky decisions.

Scientists gave Rats the option of a “sure bet” (a modest but guaranteed reward) or a lottery with a fixed probability. A sound was broadcast to the rats on each trial to convey the size of the prospective lottery prize.

Six noises were given, each representing a different lottery offer. The rats should never opt to play the lottery because the poorest offer was zero. As there is never a reward-maximizing strategy that would pick zero, this provided them with a baseline.

Scientists can then evaluate the offer-independent biases, which helped us better estimate the proper risk tolerance of the rats. The frontal orienting field (FOF) and posterior parietal cortex (PPC) were temporarily silenced to assess the causal function of the frontal and parietal cortex in the rats’ judgments about whether to play the lottery. To validate the findings, the scientists applied pharmacological and optogenetic silencing.

The scientists discovered that the animals were less ready to take risks when FOF was suppressed (either through pharmacological or optogenetic silencing). In contrast, there was a smaller, transient effect when PPC was silenced. Using a Bayesian hierarchical model, the scientists discovered that FOF affected risk tolerance rather than decision bias. The rats continued to play the lottery when the potential reward was huge but became less inclined to do so when the lottery had a middle-of-the-road potential value. As anticipated, their behavior remained the same when the lottery’s potential worth was low.

Scientists developed a dynamical model of FOF silencing to comprehend this behavior in a better manner. According to the model, the FOF codes the lottery’s value and contrasts it with the surebet’s remembered value, which remained constant from trial to trial.

As a result, when FOF is turned off, the value of the lottery, which is dynamic since it is encoded trial by trial, shrinks, but the value of the surebet does not. The rats change to choosing the surebet as a result.

The study’s findings revealed that this shift toward the sure bet usually happened for choices close to the boundary where the predicted value of the lottery was just barely higher than the sure bet’s value. This is because the expected value of the lotteries with much higher potential values than the sure bet were still higher even after the negative shift from the FOF silencing.

Jeffrey Erlich, Group Leader at the Sainsbury Wellcome Centre and corresponding author on the paper said, “Behaviourally, we found that the effect of FOF silencing caused a change in risk preference. The way we think this can be explained is that the FOF is tracking the value of the lottery and comparing it to the value of the surebet. Therefore, silencing the FOF diminishes the animal’s estimate of the value of the lottery. Our simulation validated this hypothesis, and when we recorded from neurons in FOF, we found that they encoded the value of the lottery.”

Scientists further want to explore the inputs and outputs of FOF to understand the complete neural circuit. They are also developing a new version of the task that allows multistage decision-making through a second cue in addition to the sound. This will allow them to delve into how decisions are transformed into actions.

Journal Reference:

- Bao, C., Zhu, X., Mōller-Mara, J. et al. The rat frontal orienting field dynamically encodes value for economic decisions under risk. Nat Neurosci (2023). DOI: 10.1038/s41593-023-01461-x